ARM official announcement: self-developed chip

The quarterly forecast released by chip technology provider Arm Holdings disappointed investors, partly due to the company's plan to invest some of its profits in manufacturing its own chips and other components. The company's stock price plummeted 8% in after hours trading on Wednesday.

Due to the potential impact of global trade tensions on Arm's demand in its main smartphone market, the company predicts slightly lower than expected profits for the second quarter, failing to meet the needs of investors who have driven its stock price soaring in recent months.

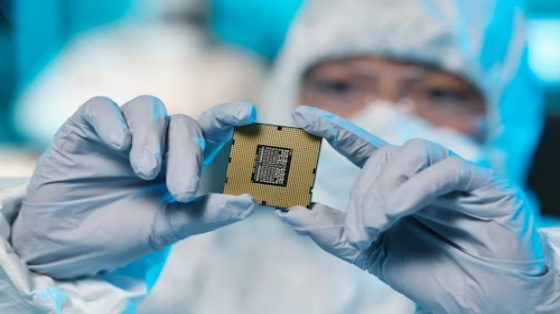

The plan to increase investment in independent chip development marks a change in Arm's long-standing business model of providing intellectual property to companies such as Nvidia and Amazon, which have already designed their own chips.

Arm CEO Rene Haas stated that the finished chip is the "physical embodiment" of the computing subsystem (CSS) that Arm is already selling.

Haas said in an interview with Reuters, "We have consciously decided to increase investment in order to go beyond design, build something, create small chips, and even possible solutions

A chipset is a smaller version of a larger chip with specific functions that designers can use as building blocks to construct a complete processor. The solution integrates hardware and software.

The company stated that if Arm decides to halt development or suspend various projects, the decision to increase investment in potential chips, chipsets, and solutions may not result in a product.

If the company chooses to manufacture the entire chip, it will erode the company's profits and cannot guarantee success. The cost of advanced AI chips alone is as high as $500 million, and the cost of server hardware and software required to support the chip may be even higher.

In order to cultivate the workforce required for producing small chips and other finished chips, Arm has been recruiting talent from its customers and competing with them for transactions.

Haas refused to disclose the specific timeline for the company's new strategic investment to be converted into profits, nor did it reveal the specific details of the new products that may be launched in the plan. But he said that Arm will focus on chips, "including physical chips, motherboards, systems, and all of the above

For many years, Arm, a subsidiary of SoftBank Group, has been ambitiously committed to expanding revenue and increasing profits by launching new products with higher profit margins such as CSS technology, as well as raising patent fees for each chip. During an experiment in December last year, Arm executives discussed the production of chips independently, and the details were exposed.

The decision to build its own chips may lead to direct competition between Arm and customers such as Nvidia who rely on the company's intellectual property.

Arm's chip technology powers almost every smartphone worldwide, and its moderate predictions highlight the uncertainty that US President Donald Trump's tariff policies bring to global manufacturers and their suppliers.

According to data from the London Stock Exchange, Arm, headquartered in the UK, predicts its adjusted earnings per share for the second quarter to be between 29 cents and 37 cents, with the median lower than analysts' average expectation of 36 cents per share.

Summit Insights analyst Kinngai Chan said, "The performance and outlook are poor, below expectations

Since its stock listing in 2023, Arm's stock price has soared by about 150%, with its recent P/E ratio exceeding 80 times expected earnings, far higher than the P/E valuations of Nvidia, Advanced Micro, and other AI focused chip manufacturers.

Smartphones remain Arm's biggest fortress. Morningstar analysts predict that Arm will continue to be the main architecture provider in the smartphone processor field, with a market share of up to 99% in this area.

However, the global trade tensions have cast a shadow over the market outlook.

International Data Corporation stated that the uncertainty caused by tariff fluctuations and ongoing macroeconomic challenges has weakened end market demand, with global smartphone shipments only increasing by 1% between April and June.

Arm expects revenue for this quarter to be between $1.01 billion and $1.11 billion, consistent with the expected $1.06 billion.

The company announced first quarter sales of $1.05 billion, slightly lower than the expected $1.06 billion. Adjusted earnings per share were 35 cents, in line with expectations.

Related Information

- 2025.05.12 Intel terminates Deep Link program