Strong demand for semiconductors in 2025

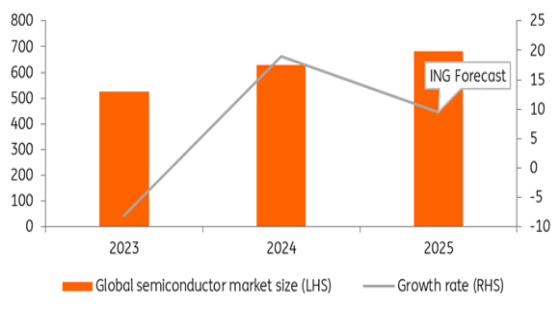

According to ING's forecast, the global semiconductor market is expected to grow by 9.5% in 2025, driven by strong demand for data center services, including artificial intelligence. However, the growth of other more mature niche markets is expected to stagnate. The company's forecast is lower than WSTS and other institutions' forecasts, but slightly higher than ASML's long-term growth expectations for the industry.

The COVID-19 crisis marks an interesting period in the recent history of the semiconductor industry. People have a high demand for electronic products, therefore there is also a high demand for semiconductors. This demand was initially difficult to meet, leading to an increase in semiconductor inventory. These challenges are particularly common in the automotive industry, where semiconductor shortages lead to production delays. Subsequently, inventory increased and then decreased. Indicators such as semiconductor and component inventory in South Korea indicate that inventory levels have returned to normal. However, leading industry executives have expressed concerns about the potential slowdown in the mature semiconductor market.

The market is becoming increasingly segmented, with strong growth in areas related to artificial intelligence and data centers, while more traditional fields such as personal computers, smartphones, and automobiles are experiencing growth stagnation due to semiconductor price pressures. Nvidia's recent performance has been poor, and Samsung has also lowered its expectations for AI driven demand for its products. Nevertheless, the development of artificial intelligence is still advancing rapidly, with strong growth momentum.

The leading institution WSTS (World Semiconductor Trade Statistics) predicts a global semiconductor market growth rate of 11.2%. This is lower than the previous predictions of IDC (15%) and Gartner (12.7%). The WSTS forecast is driven by a 16.8% growth in logic microchips, a 13.4% growth in memory microchips, and low single digit growth in mature technology semiconductors.

Considering weaker than expected earnings season performance, disappointing Q1 2025 guidance, signs of increased inventory, and price pressure from China, ING's outlook for mature technology is more negative than WSTS. In addition, Deepseek has demonstrated that advanced AI models can run with fewer advanced memory chips. In addition, the expansion of production capacity in the memory field may bring some price pressure. Therefore, ING is not as optimistic about the growth of the memory market as WSTS.

Therefore, ING's overall expectation for the semiconductor market growth in fiscal year 2025 is 9.5%. This is still slightly higher than ASML's assumed long-term industry trend growth rate of 9%. Despite the current negative sentiment observed in the industry, the outlook for the global semiconductor industry remains quite promising. However, as European manufacturers are not focused on cutting-edge technology, the European continent may not benefit from industry growth.

Smartphones no longer seem to be the driving force behind revenue growth in the semiconductor industry. Compared to previous generations, the recent upgrades to the iPhone have been relatively minor, with slight improvements on the iPhone 16 and disappointing AI capabilities on the iPhone 15. In addition, as Canalys, a global technology market analyst, recently stated, "suppliers are facing challenging issues in 2025 with increasing complexity. Therefore, the global smartphone market will not be the driving force for the growth of the semiconductor market in 2025. However, as the market is increasingly driven by high-end products, Samsung and Apple's revenue may increase.

The long-term growth trend of semiconductor market share in automobiles is strong, and this trend is accelerating with the popularity of electric vehicles (BEV/PHEV). However, the overall outlook for the global automotive market in 2025 is not optimistic, with ING's automotive analysts expecting a growth rate of 1.6%.

The share of electric vehicles in Europe and North America is slowly increasing. However, by 2025, the share of electric vehicles in China may approach 50%. Therefore, ING expects electric vehicle sales to increase by 19%.

Since the second half of 2024, ING has observed inventory adjustments throughout the entire automotive supply chain, which typically take about a year to stabilize. However, the increasing importance of the Chinese market makes forecasting more complex. Although China's demand exceeded expectations in the second half of 2024, there are increasing signs of oversupply in China, leading to a decline in prices.

Given the low growth in the Western world and signs of recent earnings reports, ING hopes that the automotive semiconductor market will remain stable by 2025. However, the automotive semiconductor market is notoriously unpredictable.

The trend of spending more money on semiconductors in ultra large scale data centers continues. According to Gartner's data, the expenditure on semiconductors for ultra large scale data centers will reach $112 billion in 2024, almost double the previous year. Strong growth is expected to continue.

AMD reported that its AI chip revenue exceeded $5 billion in fiscal year 2024, and it is expected that AI driven sales will reach "strong double digits" by 2025. AMD expects AI chip sales to reach "billions of dollars" in the coming years. Nvidia also believes that its sales can grow, especially due to the launch of its next-generation AI chip (Blackwell).

TSMC predicts that the revenue growth of artificial intelligence accelerators will reach a compound annual growth rate of nearly 40% within five years. This is higher than its overall long-term revenue growth expectation, which is that the compound annual growth rate in US dollars should be close to 20% for the five years starting from 2024.

ING also expects data center operators to push for the development of their own microchips, thus anticipating the rise of application specific integrated circuits (ASICs). Large scale operators seek the most cost-effective computing power as they require inexpensive AI model inference and some training applications. This can be achieved through customized ASICs. Companies such as Broadcom and Marvel will help design semiconductors, while TSMC will produce them. Over time, these products are expected to capture market share from AMD and Intel.

In 2025, ING will continue to see technological advancements in cutting-edge memory chips and strong demand for high bandwidth memory. As Deepseek has shown, this expectation carries some downside risks as data centers may invest less in high bandwidth memory chips and more in advanced computing chips. However, with the growth of data center investment, the demand for advanced node logic semiconductors looks very promising in the future.

Related Information

- 2025.05.12 Intel terminates Deep Link program