The dilemma of chip manufacturing in the United States

President Trump's chip tariff policy may disrupt global electronics trade and push up prices of various commodities. But one thing seems unlikely to happen: making a comeback for advanced chip manufacturing in the United States.

Trump threatened to impose 100% tariffs on "chips and semiconductors" last week, but also proposed exemptions. Trump stated that companies that promise to "produce in the United States" will not be required to pay tariffs.

Although the tone is vague, it appears logical on the surface. If the purpose of tariffs is to induce businesses to conduct more business in the United States, then they should receive probation when doing so.

One issue is that all major chip companies around the world have invested in production in the United States, partly due to encouragement from previous government subsidies. At the same time, other large technology companies may invest in areas outside of advanced chip production to obtain their own exemptions.

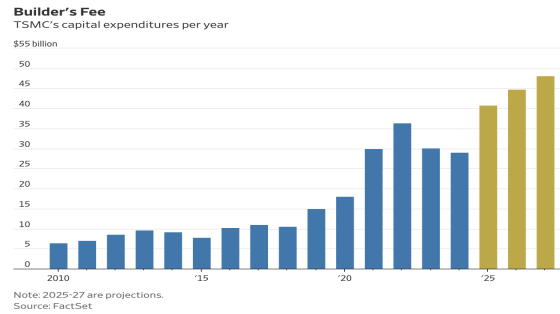

Taiwan Semiconductor Manufacturing Company is building a chip factory in northern Phoenix as part of a $165 billion investment from the United States. South Korean Samsung Electronics 005930 0.14% increase; The green upward triangle is building a $40 billion project in Texas. There are countless examples like this.

These chip manufacturers seem to have the potential to obtain tariff exemptions based on their investment scale. But if that's the case, the latest tariffs won't incentivize them to continue expanding their business in the United States. If there is really an incentive effect, it is only to make moderate investments in the United States to appease politicians, and then import other necessary products, especially considering the much higher manufacturing costs in the United States.

Rising costs in the United States have always been a core issue faced by foreign chip manufacturers, and tariffs cannot alleviate this problem. TSMC told investors last month that it expects its overall gross profit margin to decrease by 2 to 3 percentage points in the coming years due to rising US manufacturing costs. Moreover, these wafer fabs have not even taken the lead in adopting the company's most expensive and advanced processes. TSMC's factory in Arizona is currently producing chips using its N4 process, which is two generations earlier than the N2 process that the company is about to launch at its Taiwan wafer fab.

TSMC may just be a company, but advanced chip manufacturing is not an easy task. TSMC, Samsung, and Intel are the only chip manufacturers in the world that can use the most advanced process nodes for production. And Intel is struggling - in order to save cash, it has significantly laid off employees and reduced capital expenditure plans in order to catch up with TSMC. Trump's recent fierce criticism of Intel, the Malaysian CEO, has added more uncertainty to the prospects of this chip giant.

Contrary to intuition, chip tariffs may ultimately have a more significant impact on electronics companies that do not produce chips, as imposing tariffs on key imported components would result in significant losses for them. Apple's -0.83% decrease; The red downward triangle tariff exemption - obtained through a commitment to invest $600 billion over the next four years - allowed the company to avoid costs that could harm its US business.

Its peers - at least those financially strong countries - may strive for the same duty-free treatment.

If the goal is to stimulate overall investment in the US manufacturing industry, this may make sense. But if the purpose of chip tariffs is to introduce more advanced chip manufacturing into the United States, then these commitments may not be a panacea.

Apple's investment in the United States does support advanced chip manufacturing domestically: the company is the first and largest customer of TSMC's Arizona factory, and is collaborating with Samsung to develop chip manufacturing technology in Texas. But Apple has also invested heavily in server manufacturing, expanding data centers, and expanding its campus in Austin, Texas - all of which have a relatively small impact on the domestic chip industry in the United States.

It is worth noting that many of the things Apple is doing were already underway before the tariff threat. CEO Tim Cook announced at a joint press conference with President Joe Biden in 2022 that Apple will use TSMC chips in Arizona. Now that Apple has been granted tariff exemptions, tariffs do not necessarily motivate Apple to take further action.

More importantly, the US manufacturing industry will still maintain a premium, and someone must bear this cost. The tariffs and higher costs of American production will ultimately be shared among American consumers and different segments of the supply chain, "analysts from Bernstein Research wrote in a report on Thursday.

Of course, there are still ample reasons for chip manufacturers to expand in the United States. These companies have utilized funding from the 2022 Chip Act to expand their production in the United States. They can also enjoy tax credits for purchasing chip manufacturing equipment, and Trump's "Big and Beautiful Act" proposed last month also increased tax credits for these devices.

Many companies also believe that it is valuable to locate more supply chains in the United States to avoid the impact of the COVID-19 epidemic. In addition, there is a geopolitical consideration unrelated to tariffs: China's more aggressive stance towards Taiwan, escalating Middle East conflicts, or any other potential political turmoil give companies reason to hope to place more semiconductor supply chains near the mainland of the United States.

These factors have been and will continue to be the main drivers of US chip investment - not tariffs.

Related Information

- 2025.05.12 Intel terminates Deep Link program