Analog chip giant ADI achieves explosive performance

Analog chip giant ADI announced its financial performance for the third quarter of fiscal year 2025 (as of August 2, 2025) on August 20 local time, with revenue of $2.88 billion, a month on month increase of 9% and a year-on-year increase of 25%. All end markets achieved double-digit year-on-year growth. Despite facing geopolitical challenges, ADI's third quarter revenue and earnings per share still exceeded our expectations for the high-end.

"CEO and Chairman Vincent Roche stated. Vincent Roche also stated that despite the market uncertainty caused by tariffs and trade fluctuations, demand for ADI products remains strong. The company's relentless focus on cutting-edge innovation enables us to leverage the growth of intelligent physical edges. In addition, our diversified and flexible business model enables ADI to navigate various market conditions and continuously create long-term value for shareholders. "

Next, let's take a closer look at ADI's performance in various business areas and its outlook for the future market.

1. Industrial recovery accelerates, automobile decline month on month

Let's first look at the industry - ADI's most profitable business, with quarterly revenue increasing month on month, and growth accelerating in the third quarter.

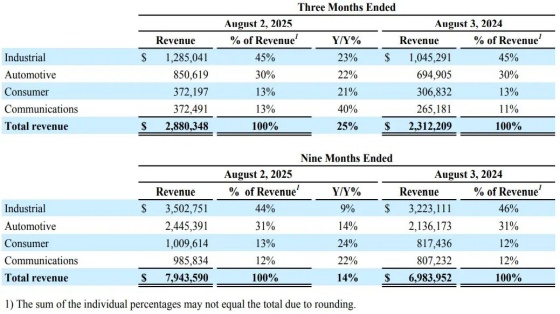

In the third quarter, ADI's industrial business revenue was approximately $1.285 billion, accounting for 45%, a month on month increase of 12%, and a year-on-year increase of 23%.

ADI stated that the company's industrial recovery continues, with all sub industries and regions achieving month on month growth. Driven by increased investment in artificial intelligence, all major applications, led by the automated testing equipment business, have accelerated year-on-year growth. In addition, ADI's aerospace and defense business revenue reached a historic high in the third quarter.

The automotive business accounted for 30% of quarterly revenue, a decrease of 1% month on month and a year-on-year increase of 22%. The company's leading connectivity and functional safety power solutions continue to drive double-digit year-on-year growth.

It is worth noting that although the automotive revenue has slightly declined compared to the previous quarter, the structural trend of automotive business growth will continue in the long run.

ADI stated during the subsequent earnings conference call that it expects automotive revenue to reach a historic high in 2025. ADI believes that the automotive business has experienced additional acceleration in the third quarter, with some order acceleration helping to boost automotive revenue in addition to the growth in market share in next-generation ADAS and infotainment systems.

The communication business accounted for 13% of quarterly revenue, a month on month increase of 18%, and a year-on-year increase of 40%. Cable and data center business accounts for about two-thirds of the total communication volume, and with the continuous growth of artificial intelligence demand, both month on month and year-on-year growth have achieved double-digit growth. The wireless business also achieved double-digit growth on a month on month and year-on-year basis.

Finally, consumer business accounted for 13% of quarterly revenue, a month on month increase of 16%, and a year-on-year increase of 21%, marking the fourth consecutive quarter of double-digit year-on-year growth. Continue to see the power of mobile phones, gaming devices, audio wearables, and smart wearables.

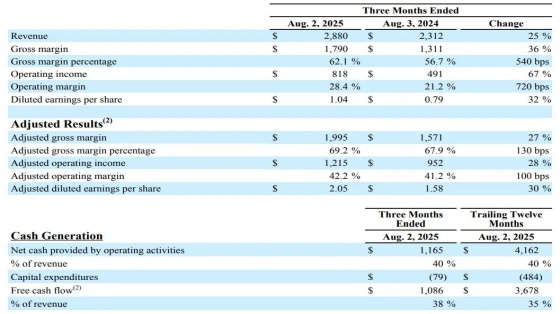

The gross profit margin of ADI Non GAAP (adjusted) in the third quarter was 69.2%, an increase of about 1.3 percentage points year-on-year, but lower than the previous quarter's 69.4%. Last quarter, ADI's gross profit margin achieved double growth on a month on month basis, mainly due to an increase in capacity utilization.

The gross profit margin for this quarter has declined compared to the previous quarter, and ADI reported an unexpected decrease in capacity utilization, which has prevented the company's gross profit margin from increasing on a month on month basis. However, the capacity utilization rate has returned to the right track and is expected to resume growth.

ADI stated during its earnings conference call that the company has deployed capital expenditures to enhance the resilience of its internal wafer fabs. ADI has more than doubled the footprint of its internal wafer fabs, which primarily support industrial operations.

In the third quarter, ADI's inventory increased by $72 million month on month to support cyclical recovery. The inventory days have decreased to 160 days, and the channel weeks have decreased.

The company believes that terminal demand is still two digits lower than consumption, and will now begin to see some catch-up on final demand in the fourth quarter. ADI will continue to execute its strategy, maintaining a more streamlined channel inventory while maintaining a high level on its balance sheet.

In terms of the spot market for ADI chips, since the rebound in the third quarter of 2024, the overall market trend has become flat, with local hotspots mainly appearing in difficult to replace materials and discontinued materials, resulting in delayed product delivery and reduced arrival volume. Due to the brief impact of tariffs in the first half of the year, a small portion of ADI's general materials experienced price increases, but since then, most of them have returned to normal prices, and the situation of price inversion has improved.

2.What do you think of this year ?

Currently, ADI's quarterly revenue is returning to the growth track.

ADI's revenue in FY25Q1 was $2.423 billion, with a year-on-year growth rate of -3.6%/month on month growth rate of -0.8%. In FY25Q2, the revenue was $2.64 billion, with a year-on-year growth rate of+22.3%/month on month growth rate of+9%, achieving very strong growth. The latest FY25Q3 results announced that the revenue increased to $2.88 billion, with a year-on-year growth rate of+25%/month on month growth rate of+9%, continuing to show strong growth.

ADI has also shown robustness in specific financial indicators.

The operating profit margin for the third quarter was 42.2%, with a month on month and year-on-year increase of 100 basis points. Non operating expenses amounted to $57 million, with a tax rate of 11.9% for this quarter. Earnings per share of $2.05, higher than the high-end guidance range of the company, increased by 30% year-on-year.

At the end of the third quarter, ADI's cash and short-term investments were $3.5 billion, with a net leverage ratio almost unchanged at 1.1. The operating cash flow for the past 12 months was $4.2 billion, and the free cash flow was $3.7 billion, accounting for 40% and 35% of the revenue, respectively. The capital expenditure for the past 12 months was $500 million, and it is expected that the capital expenditure for fiscal year 2025 will remain within the long-term model of 4% to 6% of revenue.

ADI expects its fourth quarter revenue to reach $3 billion, plus or minus $100 million. It expects revenue from its industrial, communications, and consumer businesses to continue to grow, with the industrial business growing the fastest and the automotive business expected to decline.

The strong performance and sustained growth prospects of the company, especially in the industrial market, make 2025 a year of strong recovery for ADI.

Richard Puccio, Chief Financial Officer, said, "Our backlog of orders continued to grow at the end of the third quarter, with a healthy booking trend, especially in the industrial end market. Our strong third quarter performance and continued growth prospects in the fourth quarter enable us to end the 2025 fiscal year in a strong position

For the Chinese market, ADI stated that China has been leading the company's recovery and is quite optimistic about the prospects for China in the next 3 to 5 years.

ADI has also noted the ongoing uncertainty faced by customers regarding tariffs and is closely monitoring their impact.

Another example of industrial market recovery is the analog chip giant Texas Instruments (TI).

On July 22nd local time, TI announced that its revenue for the second quarter of 2025 was 4.45 billion US dollars, an increase of 9% month on month and 16% year-on-year; Operating profit was 1.56 billion US dollars, a year-on-year increase of 25%. Both revenue and profit achieved double-digit growth year-on-year. TI President and CEO Haviv Ilian stated that this is due to the sustained and widespread recovery of the industrial market.

Whether it is ADI or TI, the performance of the two leading analog chip companies is pointing towards the same trend. With the recovery of industrial demand, the analog chip industry is ushering in a new round of growth cycle.

Related Information

- 2025.05.12 Intel terminates Deep Link program