Did the original factory intentionally reduce production? Why do storage prices continue to rise?

According to Reuters, Samsung Electronics' fourth quarter operating profit is expected to skyrocket by 160%. And Micron Technology's profit guidance released last month was also twice Wall Street's expectations.

According to the latest supply chain news, Samsung and SK Hynix have officially proposed a new round of price increase plans to DRAM customers for servers, PCs, and smartphones, with a direct increase of 60% to 70% in the first quarter of 2026 compared to the previous quarter.

A semiconductor industry insider bluntly stated that customers are actually very clear in their hearts that it is almost impossible for top manufacturers to quickly release new production capacity in the short term. Therefore, even if the increase is so aggressive, the market is likely to be forced to accept it.

How did this trend come about? What other methods can be used to solve it?

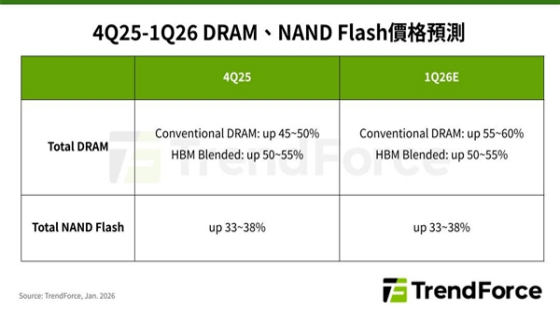

According to TrendForce's statistics, the price of a certain model of DDR5 DRAM surged 314% year-on-year in the fourth quarter of 2025. However, in the first quarter of 2026, the contract price of general DRAM is still expected to rise by 55% to 60% month on month, while the contract price of consumer grade NAND flash memory continues to rise, with an increase of 33% to 38%.

Samsung Electronics Co CEO Louis Koo publicly stated, "The severity of the current global shortage of memory chips is unprecedented, and almost no enterprise can escape. Its impact has already spread from mobile phones to various consumer electronics such as televisions and home appliances

NIO founder, chairman, and CEO Li Bin bluntly stated in an interview that the rise in memory prices is having a huge impact on the automotive industry, essentially competing with AI, computing power centers, and mobile phone manufacturers for resources, and half jokingly reminding consumers to "buy a car earlier".

Research firm Counterpoint Research also pointed out that the shortage of DRAM is expected to increase the material cost of smartphones by about 25% and may suppress overall shipment volume.

With the explosive growth in demand for AI training and inference, the demand for high-end storage such as HBM and GDDR is rapidly increasing, and the unit price of these products is much higher than that of traditional DRAM and NAND.

Taking HBM as an example, SK Hynix supplied Nvidia with a 24GB HBM3E stack at a price of approximately $370. A high-end AI graphics card typically requires six units, and the single unit price of the next generation HBM4 is even expected to exceed $500.

In the face of such a huge profit gap, the original factory will naturally prioritize investing advanced processes, equipment, and engineering resources in HBM production, compressing traditional storage and even directly exiting the production line, which has become a rational choice.

A more realistic issue is that HBM's production capacity itself has already been fully sold out. Previously, Samsung, SK Hynix, and Micron all publicly stated that the current HBM production capacity has been locked by customers, and resources are highly concentrated on products such as HBM3E.

Meanwhile, Google and Microsoft continue to expand their AI inference services, driving up the demand for general-purpose DRAM on servers; Broadcom, which customizes AI ASICs for customers, is also constantly adding HBM orders. The combination of various factors has further worsened the already tense DRAM supply and demand relationship.

Even if manufacturers intend to expand production, the actual conditions are not immediate.

The expansion of DRAM production means the establishment of new production lines, new factories, and a large number of key equipment, while the current production line itself is highly inclined towards HBM, and it often takes several years from decision-making to mass production to build new production capacity. This time difference directly leads to the supply side being unable to keep up with demand growth, and the gap can only widen.

At the same time, industry concentration has further amplified the impact of the problem.

In the DRAM market, Samsung, SK Hynix, and Micron collectively hold about 90% of the market share, and previous news about the gradual discontinuation of DDR4 caused a market shock.

When top manufacturers move forward and backward together, the contraction of supply will also be multiplied.

Recently, there have been reports that Apple's long-term DRAM supply agreements with Samsung Electronics and SK Hynix are about to expire, and Apple executives have even been stationed in South Korea for a long time, engaging in tug of war negotiations with original manufacturers in an attempt to lock in stable supply for the next two to three years. This also reflects the market's anxiety about memory resources.

In the field of NAND flash memory, market share is mainly concentrated in the hands of a few manufacturers: Samsung about 32%, SK Hynix about 20%, Micron about 13%, SanDisk about 12%, Kioxia about 14%, while Chinese manufacturer Yangtze Storage currently accounts for about 5%.

The concentration of the DRAM market is even more extreme, with SK Hynix, Samsung, and Micron accounting for nearly 90% of the global market share, with SK Hynix accounting for about 38%, Samsung accounting for about 32%, and Micron accounting for about 23%; Chinese manufacturer Changxin Storage accounts for about 5%, while Nanya Technology only accounts for about 1%..

If Yangtze Storage and Changxin Storage can continue to break through in process, yield, and product stability, and gradually expand their production capacity, then what they provide is not only new supply, but also a stabilizer for highly concentrated markets.